How to Invest in a Bear Market

The stock market spends the majority of its time breaking all-time-highs. However, as the business cycle moves from expansion to contraction, markets typically go through a volatile bear market with substantial price declines. Making sound investment decisions during these periods is crucial to protect your portfolio.

Stay Invested

For most people, there are two ways they'll get financially harmed in a bear market:

- Panicking from share price declines and selling

- Losing one's source of income (job) and being forced to sell the portfolio at a poor price to cover expenses

The majority of financial advice pushed on people is to be 100% invested all the time and buy index funds. This works most of the time but ignores the important distinction that the very wealthy can afford to be 100% invested, all of the time. If you're not very wealthy, you need to maintain some buffer.

If you rely on a job to pay your bills and do not have some cash set aside for emergencies, you should do so.

Otherwise, it's important to stay invested in the market (and add to your positions). The broad market will bottom and eventually recover.

Hold Cash

As stated before, holding cash is important because it provides security against a broad range of misfortunes and provides optionality, which is the characteristic of being able (but not obligated) to pursue various endeavors.

As prices of stocks and real estate fall, people realize they are not as wealthy as they had previously believed. The availability of credit declines. Businesses will reduce headcount in order to cut costs. Layoffs occur and businesses go under. Foreclosures and evictions increase. As incomes fall, a positive feedback of economic contraction emerges.

If you have cash before things get ugly, you'll be able to maintain your lifestyle and financial obligations for some time (with adjustments), even if you lose your job. If your situation is stable, you can look for attractive investments to purchase as the decline plays out.

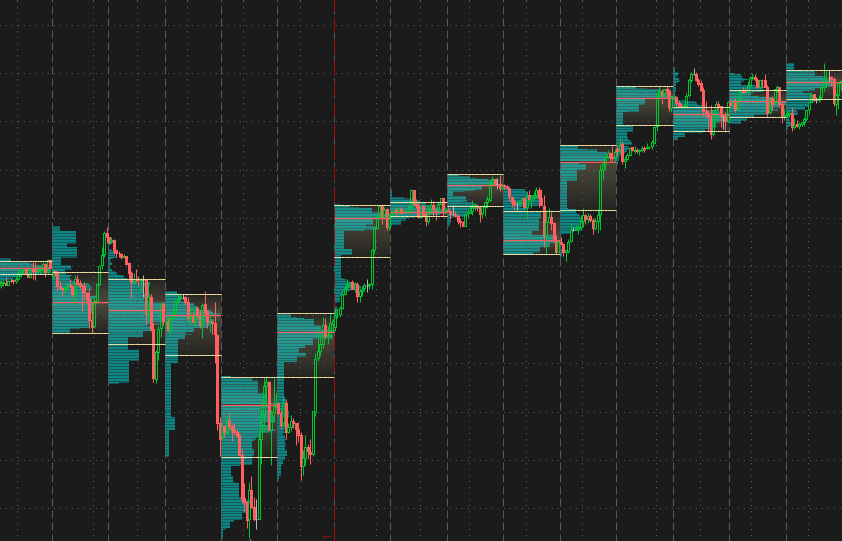

Don't Trade Short-Term (Unless!)

Shorting the market and making millions is the average Robinhooder's dream, but it's difficult to execute. Let's consider trying to short the S&P 500 with SPX put options, short SPY shares, or short E-mini contracts.

With SPX put options your risk is defined but you have to:

- get the options at an attractive price as volatility (VIX) increases

- have a substantial decline to offset the cost of the option

- size the position appropriately to justify the risk that you're taking

With short SPY shares you have to sell a substantial amount in a margin account.

- when selling short you have potentially infinite losses.

- if the correction doesn't actually materialize, or you try to sell short again as it's already underway, you could be squeezed out of the position.

- margin requirements can be changed forcing you to put up more money in order to maintain a position.

With short E-mini contracts, you have the same risks as with selling SPY shares, but with enormous leverage. You can make a lot of money (or lose a lot) in a few trading sessions.

If you're not trading actively and don't have a good understanding of how markets behave in a bear market, you should probably steer clear of short-term trading. For people looking to buy some lottery tickets, SPY or SPX put options are the lowest risk option. Just remember that as the bear market is underway, everyone prices in further declines, and buying put options expecting the market to decline another 50% after it's declined 50% is unlikely to yield a profit.

Buy the Dip

When market sentiment is extremely negative and people are looking to liquidate their accounts to prevent themselves from losing everything - this is the time to be looking to buy. When buying, dollar cost average some amount over a time period - you don't want to allocate all of your cash in one go unless you have extremely high conviction that the bottom has happened or is close at hand.

Most passive investors will just buy a broadly diversified index fund. If you decide that you would be a buyer at a certain price level, you should make a purchase:

- Purchase shares (e.g. buying SPY or VTI shares)

- Sell put options at prices you would be comfortable buying.

The second option is particularly attractive because it provides you some buffer. If the market goes below the strike price of the put option and the option is exercised, the premium you received for selling the option reduces the cost basis in the shares put to you.

For example, if you're a buyer of SPY at $300/share and it declines to $250/share, but you receive $20/share in premium for selling the option, your cost basis is $280/share. You're only down $30/share instead of $50/share. If you have the money in your account to support a cash-covered put, it may be a good idea.

Market indexes typically bounce off the bottom violently. A 20% or more bounce from the bottom nets a bottom-buyer a huge return - but the index will likely not reach a new ATH for years. Still, this move off the bottom will produce great returns for investors as the market sentiment shifts from "hopeless" to "poor".

Wait for a Return to Normal

You could be waiting a while for another bull market. Some comforting thoughts:

- Markets generally go up over time and have returns exceeding inflation in the long-term (years, decades)

- You are compensated for holding money in the stock market through dividends, which can be reinvested

- If there is high inflation, stocks usually do well (although everything else in the economy is probably not going well)

- Governments have shown a multi-decade commitment to keeping asset prices high/inflated and routinely intervene in the market. Buyers in the market crash of 2020 received an enormous bailout, and it is likely to happen again

Conclusion

Investing in a bear market is emotionally draining. It is difficult to see hard-earned money disappear each weekday, but those who maintain optimism, keep their cool, and stay the course will survive to see the next bull market expansion.